AI tariff report: Everything you need to know

In a week that saw nearly $10 trillion wiped from global markets, AI finds itself caught up in the most intense economic storm of living memory. Since Trump presented his cardboard placard of tariffs last week, the market reaction has been brutal, and tech stocks are bearing the brunt. Apple shares have fallen nearly 20% since the tariff announcement, with the company heavily exposed to Chinese manufacturing. Tesla dropped another 5% on Monday alone, and NVIDIA similarly, now trading at 25% lower than the beginning of the year. AI’s spectacular rise has been built on the foundation of a borderless The post AI tariff report: Everything you need to know appeared first on DailyAI.

In a week that saw nearly $10 trillion wiped from global markets, AI finds itself caught up in the most intense economic storm of living memory.

Since Trump presented his cardboard placard of tariffs last week, the market reaction has been brutal, and tech stocks are bearing the brunt.

Apple shares have fallen nearly 20% since the tariff announcement, with the company heavily exposed to Chinese manufacturing. Tesla dropped another 5% on Monday alone, and NVIDIA similarly, now trading at 25% lower than the beginning of the year.

AI’s spectacular rise has been built on the foundation of a borderless economy. The industry thrives on global supply chains – Taiwanese chips, Chinese assembly, European research centers, and American venture capital – all working in relative harmony.

Taiwan has been hit particularly hard, slapped with a 32% tariff that sent its stock market into its worst nosedive ever, plunging nearly 10% in days. By Tuesday, Taiwan’s Foreign Minister Lin Chia-lung was scrambling to arrange negotiations with the US, telling reporters they’re “ready for talks at any time.”

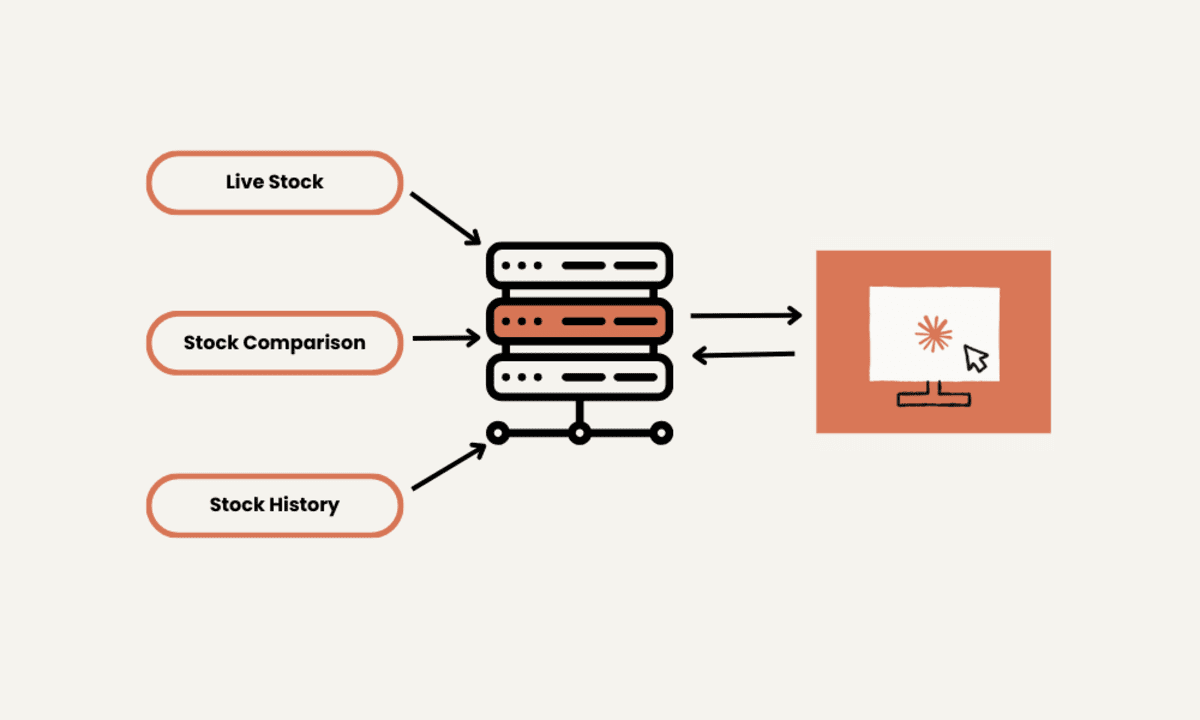

It’s not just about semiconductors, which received a temporary reprieve from tariffs. The massive data centers powering ChatGPT and other AI services rely on a global supply network for everything from cooling systems to power equipment to construction materials – all primarily now subject to tariffs.

Non-semiconductor components represent up to one-third of data center costs, Gil Luria of D.A. Davidson & Co. explained to Fortune, adding ominously that the semiconductor exemption “was not meant to be permanent.”

China, meanwhile, has retaliated with its own tariffs while its state media produces AI-generated videos mocking Trump’s economic policies.

Did ChatGPT design Trump’s tariffs?

Here’s where the story takes a bizarre turn. Shortly after Trump unveiled his tariffs, economist James Surowiecki noticed something peculiar: the formula behind the tariff calculations looked strangely familiar.

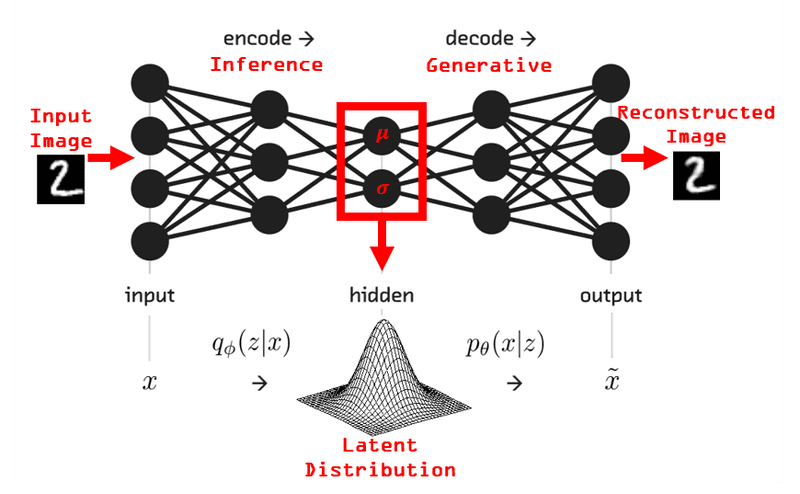

As it turns out, if you ask ChatGPT, Claude, Gemini, or Grok for “an easy way to solve trade deficits,” they all recommend essentially the same method – to divide a country’s trade deficit with the US by their exports to the US. That’s remarkably similar to what the White House appears to have done.

Just figured out where these fake tariff rates come from. They didn’t actually calculate tariff rates + non-tariff barriers, as they say they did. Instead, for every country, they just took our trade deficit with that country and divided it by the country’s exports to us.

So we… https://t.co/PBjF8xmcuv

— James Surowiecki (@JamesSurowiecki) April 2, 2025

“This is extraordinary nonsense,” Surowiecki noted, with other economists quickly piling on criticism of what appears to be overly primitive calculations.

Shifting the blame to China

As markets tanked, Treasury Secretary Scott Bessent told Tucker Carlson it wasn’t the tariffs causing the market crash, but China’s DeepSeek AI platform.

“For everyone who thinks these market declines are all based on the President’s economic policies, I can tell you that this market decline started with the Chinese AI announcement of DeepSeek,” Bessent claimed. “It’s more a Mag 7 problem, not a MAGA problem.”

When Bessent refers to the “Mag 7,” he’s talking about the “Magnificent Seven,” Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla, which have collectively driven much of the market’s recent gains.

The timeline, however, tells a different story. Global markets were relatively stable until Trump’s tariff announcement on Wednesday, after which they immediately plunged across the board. DeepSeek’s latest version was released in January, months before the current crisis began, and markets showed no comparable reaction at that time.

Market figures from other industries also undermine Bessent’s claim. The Dow Jones dropped 1,679 points in a single day following Trump’s tariff announcement – the largest single-day point drop since 2020. The timing and magnitude of the decline leave little doubt about the primary catalyst.

What comes next?

Despite the market meltdown, Trump shows no signs of backing down. When asked about pausing the tariffs, he said bluntly, “We’re not looking at that.”

Not everyone believes AI will suffer long-term damage, with some claiming AI is virtually ‘tariff-proof’ due to its inherently borderless nature and long-term strategic importance.

However, today’s frontier models run on warehouse-sized data centers filled with specialized chips, cooling systems, and power equipment sourced from all over the world. Plus, despite years of talk about reshoring semiconductor production, the US remains heavily dependent on foreign chip manufacturing.

The CHIPS Act was supposed to change that, but new domestic fabs are still years away from meaningful production, a warning sign that re-shoring is famously slow and painful.

Either way, for now, the AI industry – and virtually every other – watches and waits, hoping that market turmoil will be temporary and continuity in some form will eventually prevail.

The post AI tariff report: Everything you need to know appeared first on DailyAI.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)